UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

x¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Nielsen Holdings N.V.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | | |

| | |

| | Nielsen Holdings N.V. | | |

| | PROXY STATEMENT | | |

| | Annual Meeting of Shareholders | | |

| | |

| | May 6, 2014June 26, 2015 | | |

| | 9:00 a.m. (Eastern Time) | | |

| | | | | |

April 14, 2014

Dear Fellow Shareholders:Shareholder:

On behalf of the Board of Directors, I cordially invite you to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Nielsen Holdings N.V., a Dutch company (“Nielsen-Netherlands”), to be held on June 26, 2015, at 9:00 a.m. (Eastern Time) on Tuesday, May 6, 2014., at the offices of Clifford Chance, LLP at Droogbak 1A in Amsterdam, the Netherlands, or by visiting www.virtualshareholdermeeting.com/NLSN, for the purpose of approving, among other things, the cross-border merger between Nielsen-Netherlands and Nielsen Holdings Limited, a newly formed, wholly-owned subsidiary of Nielsen-Netherlands, organized under English law, which will be re-registered as a public limited company with the name Nielsen Holdings plc (“Nielsen-UK”) prior to the merger, with Nielsen-Netherlands being the disappearing entity and Nielsen-UK being the surviving entity (the “Merger”), pursuant to the common draft terms of the cross-border legal merger (the “Merger Proposal”), a copy of which is attached to this proxy statement/prospectus as Annex A.

We are very pleased that once again this yearIf approved by our shareholders, the Merger would result in Nielsen-UK becoming the publicly-traded parent of the Nielsen group of companies and also result in you holding Ordinary Shares in Nielsen-UK (“Ordinary Shares”) rather than shares in Nielsen-Netherlands.

Immediately after the Merger, the number of Ordinary Shares you will own in Nielsen-UK will be ablethe same as the number of shares you held in Nielsen-Netherlands immediately prior to attendthe Merger and addressyour relative economic interest in the Nielsen group will remain unchanged. After the Merger, Nielsen-UK will continue to conduct the same businesses through the Nielsen group of companies as Nielsen-Netherlands conducted prior to the Merger.

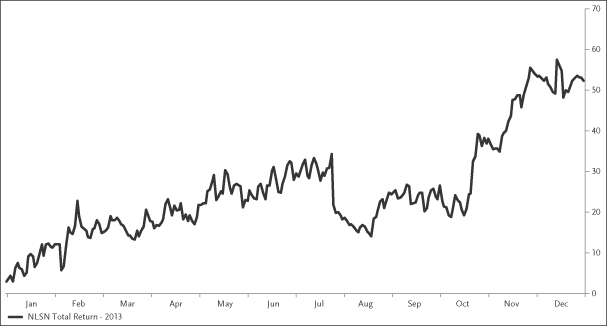

We expect the Ordinary Shares to be listed and traded in U.S. dollars on the New York Stock Exchange (“NYSE”) under the symbol “NLSN,” the same symbol under which your shares in Nielsen-Netherlands are currently listed and traded. Currently, there is no established public trading market for the shares of Nielsen-UK.

Upon completion of the Merger, we will remain subject to U.S. Securities and Exchange Commission reporting requirements, the mandates of the Sarbanes-Oxley Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act and the applicable corporate governance rules of the NYSE, and we will continue to report our consolidated financial results in U.S. dollars and under U.S. generally accepted accounting principles. After the Merger, we must also comply with any additional applicable rules and reporting requirements under English law.

Under Dutch tax law, certain holders of shares in Nielsen-Netherlands that are subject to tax in the Netherlands and realize a capital gain in connection with the Merger will generally recognize a taxable gain or loss on the exchange of such shares for Ordinary Shares in the Merger. However, such shareholders may possibly apply roll-over relief as a result of which such gain will not be recognized for Dutch tax purposes. Please see “Material Tax Considerations Relating to the Merger – Dutch Tax Considerations” for further information. Under U.S. federal income tax law, holders of shares of Nielsen-Netherlands generally will not recognize gain or loss on the exchange of such shares for shares of Nielsen-UK in the Merger.WE URGE YOU TO CONSULT YOUR OWN TAX ADVISOR REGARDING YOUR PARTICULAR TAX CONSEQUENCES.

The Merger cannot be completed without satisfying certain conditions, the most important of which is the approval of the Merger by the affirmative vote of a majority of the shares of Nielsen-Netherlands represented in person or by proxy at the Annual Meeting.

We currently anticipate that the Merger will be completed during the third quarter of 2015, although we may abandon the Merger at any time prior to the Annual Meeting and, in some circumstances, after obtaining shareholder approval.

We intend to continue our policy of Shareholders online, vote your shares electronicallymaking regular quarterly dividends on our outstanding common stock.

This proxy statement/prospectus provides you with detailed information regarding the Merger and ask questions duringother proposals to be submitted to shareholder approval at the meeting by visitingwww.virtualshareholdermeeting.com/NLSN.Annual Meeting to be held on June 26, 2015. We encourage you to read this entire proxy statement/prospectus carefully.IN PARTICULAR, YOU SHOULD CAREFULLY CONSIDER THE RISK FACTORS WE DESCRIBE STARTING ON PAGE 23.

TheOur Board of Directors has unanimously approved the Merger Proposal and recommends that you vote “FOR” the Merger. Our Board of Directors also recommends that you vote “FOR” each director nominee listed in this proxy statement/prospectus and “FOR” each other proposal described in this proxy statement/prospectus.

Our Board of Directors has fixed the close of business on April 8, 2014May 29, 2015 as the record date for the determination of shareholders entitled to notice of and to vote at ourthe Annual Meeting and any adjournments or postponements thereof.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. You may vote your shares by proxy on the Internet, by telephone or by completing, signing and promptly returning the enclosed proxy card, or by attending the Annual Meeting online. You may also submit your proxy card in person in Amsterdam, the Netherlands on the day of the Annual Meeting.

Attached to this letter are the Notice of Annual Meeting, the Proxy StatementStatement/Prospectus and the proxy card. We are also enclosing our Annual Report for the year ended December 31, 2013.2014. These proxy materials are first being mailed to shareholders on or about April 14, 2014.June 4, 2015.

Thank you for your continued support of Nielsen Holdings N.V.support.

Sincerely,

Mitch Barns

Chief Executive Officer

None of the U.S. Securities and Exchange Commission, any U.S. state securities commission or the UK’s Financial Conduct Authority (the “FCA”) has approved or disapproved of the securities to be issued in the merger or determined if this proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense. For the avoidance of doubt, this proxy statement/prospectus is not intended to be and is not a prospectus for purposes of the E.U. Prospectus Directive and/or the FCA’s Prospectus Rules.

The date of this proxy statement/prospectus is May 21, 2015, and it will be first mailed to shareholders on or about June 4, 2015.

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | |

Summary of Proxy InformationInformation/Prospectus

This summary highlights information contained elsewhere in this proxy statement.statement/prospectus. This summary does not contain all of the information you should consider. You should read the complete proxy statementstatement/prospectus and appendicesannexes before voting.

ANNUAL MEETING: TUESDAY MAY 6, 2014JUNE 26, 2015 AT 9AM9:00 A.M. E.T.

| | | | |

| | |

ATTENDING BY INTERNET www.virtualshareholdermeeting.com/NLSN You will need the 12-digit16-digit control number included on your proxy card. | | | | ATTENDING IN PERSON Offices of Clifford Chance, LLP Droogbak 1A, Amsterdam, the Netherlands You must bring the admission ticket, proxy card and photo identification. |

ANNUAL REPORT AND PROXY MATERIALS

Available atwww.proxyvote.com (use the 12-digit16-digit control number included on your proxy card) and atwww.nielsen.com/investors.

PROPOSALS TO BE VOTED UPON

THE MERGER

As a result of the Merger:

| • | | Nielsen-UK will be the surviving company and Nielsen-Netherlands will be the disappearing entity; |

| • | | all of the assets and liabilities of Nielsen-Netherlands shall transfer by universal succession of title to Nielsen-UK; |

| • | | you will receive, as consideration in the Merger, one Ordinary Share of Nielsen-UK in exchange for each share of Nielsen-Netherlands you hold immediately prior to the effective time of the Merger; |

| • | | as a result, you will become a member (as shareholders are known in the UK) of Nielsen-UK, and your rights will be governed by English law and Nielsen-UK’s articles of association, which are attached as Schedule 3 to Annex A to this proxy statement/prospectus; and |

| • | | Nielsen-UK will assume, and thereby become liable for, all employee benefit and compensation plans, arrangements and agreements that are presently sponsored, maintained or contributed to by Nielsen-Netherlands (including equity and incentive plans and any awards outstanding thereunder on the date of the Merger), (collectively, the “Assumed Plans”). |

SUMMARY OF PROXY INFORMATION/PROSPECTUS

| To the extent that an award under an Assumed Plan relates to shares of common stock in Nielsen-Netherlands, then, after the effective time of the Merger, such award shall instead relate to Ordinary Shares. The Nielsen-Netherlands shareholder approval of the Merger shall also be deemed to satisfy any requirement of shareholder approval of such amendments of the Assumed Plans and the assumption by Nielsen-UK of the Assumed Plans and any outstanding awards thereunder. |

NOMINEES FOR BOARD OF DIRECTORS

| | | | | | | | |

| Nominee | | Age | | | Principal Occupation | | Committees |

David L. Calhoun | | | 5657 | | | Head of Private Equity Portfolio Operations,

The Blackstone Group L.P. | | - |

James A. Attwood, Jr. | | | 5556 | | | Managing Director, The Carlyle Group | | Compensation, Nomination and Governance |

Mitch Barns | | | 51 | | | Chief Executive Officer, Nielsen N.V. | | - |

Karen M. Hoguet | | | 5758 | | | Chief Financial Officer of Macy’s Inc. | | Audit Compensation |

James M. Kilts | | | 6667 | | | Founding partnerPartner of Centerview Capital | | Nomination and Governance |

Harish Manwani | | | 61 | | | Former Chief Operating Officer of Unilever | | Compensation |

Kathryn V. Marinello | | | 58 | | | Senior Advisor of Ares Management LLC | | Audit |

Alexander Navab | | | 4849 | | | Member of KKR Management LLC, general partnerGeneral Partner of KKR & Co. L.P.

| | Compensation Nomination and Governance |

Robert C. Pozen | | | 6768 | | | Consultant to MFS Investment ManagementSenior Lecturer at Harvard Business School | | Audit, Nomination and Governance |

Vivek Y. Ranadivé | | | 5657 | | | Former Chief Executive Officer and Chairman of

TIBCO Software Inc.

| | Nomination and Governance |

Ganesh Rao

| | | 37 | | | Managing Director, Thomas H. Lee Partners, L.P. | | Compensation, Nomination and Governance |

Javier G. Teruel | | | 6364 | | | Partner of Spectron Desarrollo, SC | | Audit, Compensation |

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | SUMM1 |

SUMMARY OF PROXY INFORMATION

PROXY VOTING METHODS

Shareholders holding shares of our common stock of Nielsen-Netherlands at the close of business in New York on April 8, 2014May 29, 2015 may vote their shares by proxy through the Internet, by telephone or by mail or by attending the Annual Meeting online. Shareholders may also submit their proxy cards in person in Amsterdam, the Netherlands on the day of the Annual Meeting. For shares held through a bank, broker or other nominee, shareholders may vote by submitting voting instructions to the bank, broker or other nominee. To reduce our administrative and postage costs, we ask that shareholders vote through the Internet or by telephone, both of which are available 24 hours a day, seven days a week. Shareholders may revoke their proxies at the times and in the manners described on page 411 of thethis Proxy Statement.Statement/Prospectus.

If you are a shareholder of record or hold shares through a broker, bank or other nominee and are voting by proxy through the Internet, by telephone or by mail, your vote must be received by 11:59 p.m. (Eastern Time) on May 5, 2014June 25, 2015 to be counted.

If you hold shares through Nielsen’s 401(k) plan, trusteed by Fidelity Management Trust Company, your vote must be received by 11:59 p.m. Eastern Time on May 1, 2014.June 23, 2015. Those votes cannot be changed or revoked after that time, and those shares cannot be voted in person or online at the Annual Meeting.

SUMMARY OF PROXY INFORMATION/PROSPECTUS

TO VOTE BY PROXY:

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| |

BY INTERNET • Go to the website

www.proxyvote.com

and follow the instructions,

24 hours a day,

seven days a week. • You will need the 12-digit

16-digit Control Number included

on your proxy card in order

to vote online. | | | | | | | | | |

BY TELEPHONE • From a touch-tone phone,

dial1-800-690-6903

and follow the recorded

instructions, 24 hours a day,

seven days a week. • You will need the 12-digit

16-digit Control Number included

on your proxy card in order

to vote by telephone. | | | | | | | |

BY MAIL • Mark your selections on

the enclosed proxy card. • Date and sign your name

exactly as it appears on

your proxy card. • Mail the proxy card in the

postage-paid envelope that

will be provided to you. | | |

YOUR VOTE IS IMPORTANT. THANK YOU FOR VOTING.

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | SUMM2SUM3 |

Notice of Annual Meeting of Shareholders

| | | | |

| TIME | | 9:00 a.m. (Eastern Time) on Tuesday, May 6, 2014.June 26, 2015. |

| |

| PLACE | | You may attend our Annual Meeting in person at the offices of Clifford Chance, LLP at Droogbak 1A in Amsterdam, the Netherlands. You must bring the admission ticket included with your proxy card and photo identification to gain entrance to the Annual Meeting in Amsterdam. Nielsen directors and members of management will attend the Annual Meeting via live webcast. You will also be able to attend the Annual Meeting online, vote your shares electronically and ask your questions and discuss matters of relevance during the meeting by visitingwww.virtualshareholdermeeting.com/NLSN. You will need the 12-digit16-digit control number included on your proxy card to enter the meeting. |

| | |

| ITEMS OF BUSINESS | |  | | To (a) approve the amendment of the articles of association of Nielsen-Netherlands in connection with the proposed Merger , and (b) authorize any and all lawyers and (deputy) civil law notaries practicing at Clifford Chance, LLP, Amsterdam, the Netherlands, to execute the notarial deed of amendment of the articles of association to effect the aforementioned amendment of the articles of association; |

| | |

| |  | | To approve the Merger; |

| | |

| |  | | To (a) discuss the annual report of the Board of Directors required by Dutch law for the year ended December 31, 2013,2014, (b) discuss director compensation required by Dutch law for the year ended December 31, 2013,2014, (c) adopt our Dutch statutory annual accounts for the year ended December 31, 20132014 and (d) authorize the preparation of our Dutch statutory annual accounts and the annual report of the Board of Directors required by Dutch law, both for the year ending December 31, 2014,2015, in the English language; |

| | |

| |   | | To discharge the members of the Board of Directors from liability pursuant to Dutch law in respect of the exercise of their duties during the year ended December 31, 2013;2014; |

| | |

| |   | | To elect the Directors of the Board of Directors as listed herein; |

| | |

| |   | | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2014;2015; |

| | |

| |   | | To appoint Ernst & Young Accountants LLP as our auditor who will audit our Dutch statutory annual accounts for the year ending December 31, 2014;2015; |

| | |

| |  | | To approve the Nielsen Holdings Executive Annual Incentive Plan; |

| | |

| |   | | To approve the extension of the authority of the Board of Directors to repurchase up to 10% of our issued share capital (including depositary receipts issued for our shares) until November 6, 2015December 26, 2016 on the open market, through privately negotiated transactions or in one or more self tenderself-tender offers for a price per share (or depositary receipt) not less than the nominal value of a share and not higher than 110% of the most recently available (as of the time of repurchase) price of a share (or depositary receipt) on any securities exchange where our shares (or depositary receipts) are traded; |

| | |

| |  | | To (a) approve the amendment of the articles of association to reflect the change of the name of the Company to Nielsen N.V. and (b) authorize any and all lawyers and (deputy) civil notaries practicing at Clifford Chance LLP, Amsterdam, the Netherlands, to execute the notarial deed of amendment of the articles of association to effect the aforementioned amendment of the articles of association; |

| | |

| |  | | To approve in a non-binding, advisory vote the compensation of our named executive officers as disclosed in the Proxy StatementStatement/Prospectus pursuant to the rules of the Securities and Exchange Commission; and |

| | |

| |  | | To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | |

| RECORD DATE | | April 8, 2014.May 29, 2015. |

| |

| ANNUAL REPORT | | A copy of our Annual Report is available atwww.proxyvote.com andwww.nielsen.com/investors. You will need the 12-digit16-digit control number included on your proxy card in order to access the Annual Report onwww.proxyvote.com. |

| |

| VOTING BY PROXY | | To ensure your shares are voted, you may vote your shares over the Internet, by telephone or by completing, signing and returning the enclosed proxy card by mail. Shareholders may also submit their proxy cards in person in Amsterdam, the Netherlands on the day of the Annual Meeting. Internet, telephone and mail proxy voting procedures are described in the preceding section entitled Proxy Voting Methods, in the General Information about the Merger and the Annual Meeting section beginning on page 1 of the Proxy StatementStatement/Prospectus and on the proxy card. For shares held through a bank, broker or other nominee, you may vote by submitting voting instructions to your bank, broker or other nominee. |

Whether or not you plan to attend the Annual Meeting, please vote electronically or by telephone or please sign and date the enclosed proxy card and return it promptly.promptly. If shares are held through a bank, broker or other nominee, you may vote by submitting voting instructions to your bank, broker or other nominee. You may revoke a previously delivered proxy at any time prior to the Annual Meeting. Shareholders may vote at the Annual Meeting, thereby canceling any previous proxy, provided that if your shares are held through a bank, broker or other nominee you will need to obtain a proxy, executed in your favor, from the shareholder of record (bank, broker or other nominee) to be able to submit your vote in person in Amsterdam, the Netherlands on the day of the Annual Meeting. Shares held through Nielsen’s 401(k) plan cannot be voted in person or online at the Annual Meeting.

By Order of the Board of Directors,

Harris Black

Corporate Secretary

This Notice of Annual Meeting, the Proxy StatementStatement/Prospectus and the proxy card are being mailed

on or about April 14, 2014.June 4, 2015.

Table of contents

This proxy statement/prospectus incorporates documents by reference which contain important business and financial information about us that is not included in this proxy statement/prospectus and which are described under “Incorporation by Reference.” These documents are available at no charge to any person, including any beneficial owner, upon request directed to us c/o Corporate Secretary, Nielsen Holdings N.V., 40 Danbury Road, Wilton, Connecticut 06897, telephone (203) 563-3500. In order to ensure timely delivery of these documents, any request should be made no later than five days prior to the date of the annual meeting. The exhibits to these documents will generally not be made available unless they are specifically incorporated by reference in this proxy statement/prospectus.

You should rely only on the information contained in or incorporated by reference in this proxy statement/prospectus. We have not authorized anyone else to provide you with different information. The information contained or incorporated by reference in this proxy statement/prospectus is accurate only as of the date thereof (unless the information specifically indicates that another date applies), or in the case of information incorporated by reference, only as of the date of such information, regardless of the time of delivery of this proxy statement/prospectus. Our business, financial condition, results of operations and prospects may have changed since such dates. Therefore, you should not rely upon any information that differs from or is in addition to the information contained in this proxy statement/prospectus or in the documents incorporated by reference.

Neither Nielsen-Netherlands nor Nielsen-UK is making an offer of securities in any country, state, province, or territory where the offer is not permitted. For the avoidance of doubt, this proxy statement/prospectus is not intended to be and is not a prospectus for purposes of the E.U. Prospectus Directive and/or the FCA’s Prospectus Rules.

Table of Contentscontents continued

Table of contents continued

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | |

Table of Contentscontents continued

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | |

General Information about the Merger and the Annual Meeting

WHY AM I BEING PROVIDED WITH THESE MATERIALS?

We have delivered printed versions of this Proxy Statement,The following questions and answers are intended to address briefly some commonly asked questions regarding the enclosed proxy cardproposed Merger and our Annual Report for the year ended December 31, 2013 (together referred to as the “Proxy Materials”) to you by mail in connection with the solicitation by the Board of Directors (the “Board of Directors” or the “Board”) of Nielsen Holdings N.V. (“Nielsen,” “we” or the “Company”) of proxies to be voted at our Annual Meeting of Shareholders to be held on May 6, 2014 (the “Annual Meeting”), and at any adjournments or postponements of the Annual Meeting. Directors, officersThese questions and other Company employees alsoanswers may solicit proxiesnot address all questions that may be important to you. Please refer to the more detailed information contained elsewhere in this proxy statement/prospectus, its annexes and the documents referred to or incorporated by telephone or otherwise. Banks, brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners. We have retained D.F. King & Co., Inc. to assistreference in soliciting proxies.this proxy statement/prospectus for more information. For instructions on obtaining the documents incorporated by reference, see “Incorporation by Reference.”

| Q: | WHY AM I RECEIVING THIS PROXY STATEMENT/PROSPECTUS? |

| A: | We have delivered printed versions of this Proxy Statement/Prospectus, the enclosed proxy card and our Annual Report for the year ended December 31, 2014 (together referred to as the “Proxy Materials”) to you by mail in connection with the solicitation by the board of directors of Nielsen-Netherlands of proxies to be voted at our Annual Meeting of Shareholders to be held on June 26, 2015, and at any adjournments or postponements of the Annual Meeting. Our Board has unanimously approved a corporate reorganization of the Nielsen group, which would result in the establishment of a newly formed holding company under English law becoming the publicly traded parent of the Nielsen group of companies and result in you holding shares in the new holding company rather than a Dutch company. The corporate reorganization will be effected by the Merger and requires shareholder approval, which is why we included the proposal in the annual meeting of stockholders and sent you this proxy statement/prospectus. Banks, brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners. We have retained D.F. King & Co., Inc. to assist in soliciting proxies. You are invited to attend the Annual Meeting and vote your shares online or by submitting your proxy card in person.We encourage you to read this proxy statement/prospectus carefully. |

| A: | The Merger is the method by which we will effect the corporate reorganization of the Nielsen group. As a result of the Merger, Nielsen-Netherlands will merge into Nielsen-UK with Nielsen-UK being the surviving entity and Nielsen-Netherlands being the disappearing entity. Upon completion of the Merger, you will receive, as consideration, one Ordinary Share of Nielsen-UK in exchange for each share of Nielsen-Netherlands you hold immediately prior to the Merger, and all the assets and liabilities of Nielsen-Netherlands shall transfer by universal succession of title to Nielsen-UK. After the Merger, Nielsen-UK will continue to conduct the same businesses through the Nielsen group of companies as Nielsen-Netherlands conducted prior to the Merger. |

| Q: | WHO ARE THE PARTIES TO THE MERGER? |

| A: | The parties to the Merger described in this proxy statement/prospectus are Nielsen-Netherlands and Nielsen-UK, a newly-formed company incorporated under English law. Nielsen-UK is currently a wholly-owned subsidiary of Nielsen-Netherlands. |

| Q: | WHY DO YOU WANT TO HAVE YOUR PUBLICLY-TRADED PARENT INCORPORATED IN ENGLAND AND WALES? |

| A: | In reaching its decision to approve the Merger Proposal and recommend the Merger for your approval, the Nielsen-Netherlands board of directors identified several potential benefits of having our publicly-traded parent incorporated in England and Wales, including the following: |

| • | | As a company incorporated in England and Wales, we will have increased flexibility to expand our shareholder base globally. We are currently limited in this regard by the terms of the tax treaty between the United States and the Netherlands (the “Dutch Treaty”), which contains shareholder residency requirements. These requirements are |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| anticipated to increasingly limit our ability to achieve this objective, particularly now that our initial private equity investors have sold a significant portion of their shares and more of our common stock is traded on the open market. |

| • | | As a publicly-traded company incorporated in England and Wales, we could ensure that our officers and other key personnel are able to spend their time in jurisdictions that best meet the needs of our business and growth strategy. Under the currently applicable Dutch Treaty we may, under certain conditions, need to relocate our senior management to the Netherlands where we currently do not have a substantial presence. |

| • | | England and Wales have a well-developed legal system and corporate law. In addition to being subject to applicable English rules, after the Merger, Nielsen will continue to be listed on the NYSE and therefore be subject to the SEC and NYSE rules and their robust corporate governance requirements. Nielsen-UK is generally expected to have the same directors, executive officers, committees and corporate governance practices as those of Nielsen-Netherlands. Please see “Comparison of Rights of Shareholders.” |

| Though we expect the Merger should provide us the benefits described above, the Merger will expose Nielsen-Netherlands and its shareholders to some risks. Our board of directors was cognizant of and considered a variety of risks or potential risks, including the possibility of uncertainty created by the Merger and the change in our legal domicile, the fact that we expect to incur costs to complete the Merger, the fact that English corporate law imposes different and additional obligations on us and other risks discussed in the discussion under “Risk Factors Relating to the Merger.” After completing its review of the expected benefits and the potential advantages of the Merger, our board of directors unanimously approved the Merger Proposal, and has recommended that shareholders vote for the Merger. Nevertheless, we cannot assure you that the anticipated benefits of the Merger will be realized. |

| Q: | WILL THE PARENT COMPANY RELOCATE ITS HEADQUARTERS TO THE UNITED KINGDOM? |

| A: | No. We will keep our headquarters in the United States. |

| Q: | WILL THE MERGER AFFECT OUR CURRENT OR FUTURE OPERATIONS? |

| A: | While changing the incorporation of our publicly-traded parent is expected to position Nielsen to capture the benefits described above, we believe that the Merger should otherwise have no material impact on how we conduct our day-to-day operations. Where we conduct our future operations for our customers will depend on a variety of factors including the worldwide demand for our services and the overall needs of our business, independent of our legal domicile. Please read “Risk Factors Relating to the Merger” for a discussion of various ways in which the Merger could have an adverse effect on us. |

| Q: | WILL THE MERGER DILUTE MY ECONOMIC INTEREST? |

| A: | The Merger will not dilute your economic interest in the Nielsen group. Immediately after consummation of the Merger, Nielsen-UK will own, directly or indirectly, all of the subsidiaries constituting the Nielsen group. Further, you will own the same number of Ordinary Shares of Nielsen-UK as the number of shares you owned of Nielsen-Netherlands. Finally, the number of outstanding Ordinary Shares of Nielsen-UK will be the same as the number of outstanding shares of Nielsen-Netherlands immediately before consummation of the Merger, subject to the effects of the Merger described under “Proposals Relating to the Merger – Introduction.” |

| Q: | WILL THE MERGER RESULT IN ANY CHANGES TO MY RIGHTS AS A SHAREHOLDER? |

| A: | Nielsen-UK’s proposed articles of association differ from Nielsen-Netherlands’s articles of association mostly to the extent that English corporate law differs from Dutch corporate law. Other than as required by English law or Dutch law, we believe that the rights of shareholders under Nielsen-UK’s articles of association are comparable to those under Nielsen-Netherlands’s articles of association. We summarize the differences in your rights as a member (as shareholders are known in the UK) resulting from the Merger under “Comparison of Rights of Shareholders.” |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| Q: | WILL THE MERGER AFFECT OUR QUARTERLY DIVIDEND POLICY? |

| A: | No. Following the completion of the Merger, we intend to continue our policy of making regular quarterly dividends on our outstanding common stock, which was adopted by the board of directors of Nielsen-Netherlands on January 31, 2013. As long as you are a holder of Nielsen shares on the applicable record date, you will receive any dividends declared during 2015 regardless of which Nielsen entity declares or pays them. |

| Q: | WHAT ARE THE MAJOR ACTIONS THAT HAVE BEEN PERFORMED OR WILL BE PERFORMED TO EFFECT THE MERGER? |

| A: | We have taken or will take the actions listed below to effect the Merger. |

| • | | Nielsen-UK was formed as a wholly-owned subsidiary of Nielsen-Netherlands; |

| • | | the Merger Proposal was unanimously approved by the boards of directors of Nielsen-Netherlands and Nielsen-UK; and |

| • | | conditional upon approval of the Merger by its shareholders, and the satisfaction or waiver to the extent permitted by applicable law of the other conditions to completing the Merger as set out in the Merger Proposal, Nielsen-Netherlands will merge with Nielsen-UK, and the Merger will be effective. |

| As a result of the Merger: |

| • | | all assets and liabilities of Nielsen-Netherlands shall transfer by universal succession of title to Nielsen-UK; |

| • | | Nielsen-Netherlands shall cease to exist; |

| • | | each shareholder will receive, as consideration in the Merger, one Ordinary Share of Nielsen-UK in exchange for each share of Nielsen-Netherlands held immediately prior to the effective time of the Merger (excluding treasury shares held by Nielsen-Netherlands); |

| • | | each share of Nielsen-Netherlands will be cancelled and will cease to exist; and |

| • | | Nielsen-UK will assume all rights and obligations of Nielsen-Netherlands (including under the employee equity-based plans of Nielsen-Netherlands) by operation of law. |

| Q: | WILL THE MERGER HAVE AN IMPACT ON OUR OPERATING EXPENSES OR EFFECTIVE TAX RATE? |

| A: | We do not expect the Merger to have a material effect on our operating costs, including our selling, general and administrative expenses. In addition, we do not expect the Merger to materially affect our worldwide effective corporate tax rate. |

| Q: | IS THE MERGER TAXABLE TO ME? |

| A: | Under U.S. federal income tax law, holders of shares of Nielsen-Netherlands generally will not recognize gain or loss on the exchange of such shares for Ordinary Shares of Nielsen-UK in the Merger. Please see “Material Tax Considerations Relating to the Merger – U.S. Federal Income Tax Considerations” for further information. |

| As is discussed below under “Material Tax Considerations Relating to the Merger – Dutch Tax Considerations,” under Dutch tax law, holders of shares in Nielsen-Netherlands will not be subject to Dutch dividend withholding tax as a result of the Merger, unless a shareholder exercises its withdrawal right and receives compensation. On payments of cash compensation, dividend withholding tax at a rate of 15% will generally be withheld if and to the extent that such payments exceed the average capital recognized as paid-up on the relevant shares for Dutch dividend withholding tax purposes. Certain holders of shares in Nielsen-Netherlands that are subject to tax in the Netherlands and realize a capital gain in connection with the Merger will generally be subject to corporate income tax or income tax in the Netherlands, provided that shareholders receiving shares in Nielsen-UK in exchange for all their shares in Nielsen-Netherlands in the Merger may possibly apply roll-over relief (doorschuiving) as a result of which such gain will not be recognized for Dutch tax purposes. |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| For UK tax purposes, holders of shares of Nielsen-Netherlands who are not resident in the UK for UK tax purposes should not be subject to UK corporation tax or capital gains tax as a result of the Merger unless they carry on a trade in the UK through a permanent establishment (where the shareholder is a company) or a trade, profession or vocation in the UK through a branch or agency (where the shareholder is not a company) and has used, held or acquired such shares for the purposes of such trade, profession or vocation or such permanent establishment, branch or agency (as appropriate). Individual shareholders who may be treated as being temporarily non-resident for UK tax purposes should however have regard to the further details described in “Material Tax Considerations Relating to the Merger – UK Tax Considerations.” |

| Please refer to “Material Tax Considerations Relating to the Merger” for a description of the material U.S. federal income tax and certain Dutch and UK tax consequences of the Merger to Nielsen-Netherlands and its shareholders. Determining the actual tax consequences of the Merger to you may be complex and will depend on your specific situation. |

You are invitedurged to attendconsult your tax advisor for a full understanding of the Annual Meeting and vote your shares online or by submitting your proxy card in person.

WHAT WILL I NEED IN ORDER TO ATTEND THE ANNUAL MEETING?tax consequences of the Merger to you.

| Q: | HAS THE U.S. INTERNAL REVENUE SERVICE, DUTCH TAX AUTHORITY OR H.M. REVENUE & CUSTOMS RENDERED AN OPINION ON THE MERGER? |

We will be hosting the Annual Meeting live via the Internet. Any shareholder can attend the Annual Meeting live via the Internet atwww.virtualshareholdermeeting.com/NLSN. The webcast will start at 9:00 a.m. (Eastern Time). You will need your 12-digit control number included on your proxy card in order to be able to enter the Annual Meeting. Instructions on how to attend and participate via the Internet are posted atwww.virtualshareholdermeeting.com/NLSN.

Any shareholder can also attend our Annual Meeting at the offices of Clifford Chance, LLP at Droogbak 1A in Amsterdam, the Netherlands. Nielsen directors and members of management will attend the Annual Meeting via live webcast. The Annual Meeting will start at 9:00 a.m. (Eastern Time). To gain physical access to the Annual Meeting, you must bring photo identification along with the admission ticket included with your proxy card. A person who wishes to exercise the right to vote at the Annual Meeting in Amsterdam must sign the attendance list prior to the meeting, stating his or her name, the name(s) of the person(s) for whom he or she acts as proxy, the number of shares he or she is representing and, as far as applicable, the number of votes he or she is able to cast. You may vote shares held through a bank, broker or other nominee in person in Amsterdam only if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares. Shares held through Nielsen’s 401(k) plan cannot be voted in person or online at the Annual Meeting.

| A: | While no ruling has been or will be requested from the Internal Revenue Service (“IRS”) regarding the U.S. federal income tax consequences of the Merger, it is a condition to closing of the Merger that we receive an opinion from our tax counsel, Simpson Thacher & Bartlett LLP, confirming, as of the effective date of the Merger, the matters discussed under “Material Tax Considerations Relating to the Merger – U.S. Federal Income Tax Considerations.” Please see “Summary – Merger Conditions” as well as “Material Tax Considerations Relating to the Merger – U.S. Federal Income Tax Considerations.” |

| We have received a ruling from the Dutch Tax Authority (de Belastingdienst) (the “DTA”) confirming that (1) no corporate income tax will be imposed in respect of the deemed transfer of Valcon Acquisition B.V. by Nielsen-Netherlands as a result of the Merger by virtue of the application of the Dutch participation exemption (deelnemingsvrijstelling), and (2) the Merger will not result in the imposition of a dividend withholding tax for shareholders receiving shares in Nielsen-UK in exchange for all their shares in Nielsen-Netherlands in the Merger. |

| No ruling has been obtained from H.M. Revenue & Customs (“HMRC”) regarding the UK tax consequences of the Merger. |

| Q. | IS THE MERGER A TAXABLE TRANSACTION FOR EITHER NIELSEN-NETHERLANDS OR NIELSEN-UK? |

Shareholders may vote and ask questions while attending the Annual Meeting.

| A: | The Merger constitutes a taxable transaction for Dutch corporate income tax purposes pursuant to which all assets and liabilities are deemed for Dutch tax purposes to be transferred at fair market value. However, by virtue of the application of the Dutch participation exemption (deelnemingsvrijstelling) that will apply to gains or losses realized on the deemed transfer of the shares in Valcon Acquisition B.V., it is not expected that the Merger will result in any substantial tax liability that would result in Nielsen-Netherlands paying corporate income tax. |

| We expect that neither Nielsen-Netherlands nor Nielsen-UK will be subject to UK corporation tax as a result of the Merger. |

| Q: | WILL THERE BE UK WITHHOLDING TAX ON FUTURE DIVIDENDS, IF ANY, BY NIELSEN-UK? |

WHAT AM I VOTING ON?

| A: | No. Under current UK tax legislation, any future dividends paid by Nielsen-UK will not be subject to withholding or deduction on account of UK tax, irrespective of the tax residence or the individual circumstances of the recipient shareholder. |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

There are nine proposals scheduled to be voted on at the Annual Meeting:

| Q: | WHAT TYPES OF INFORMATION AND REPORTS WILL NIELSEN-UK MAKE AVAILABLE FOLLOWING THE MERGER? |

| A: | After the effective time of the Merger, we will remain subject to U.S. Securities and Exchange Commission (the “SEC”) reporting requirements, the mandates of the Sarbanes-Oxley Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act and the applicable corporate governance rules of the NYSE, and we will continue to report our consolidated financial results in U.S. dollars and under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). We also must comply with any additional applicable rules and reporting requirements under English law. |

| For so long as Nielsen-UK has a class of securities listed on the NYSE, Nielsen-UK will continue to be subject to rules regarding proxy solicitations and tender offers and the corporate governance requirements of the NYSE, the U.S. Securities Exchange Act of 1934 (“Exchange Act”), as amended, and the Sarbanes-Oxley Act including, for example, independence requirements for audit, compensation and nominating/corporate governance committee composition, annual certification requirements and auditor independence rules, unless certain circumstances change. To the extent possible under English law, Nielsen-UK’s corporate governance practices are expected to be comparable to those of Nielsen-Netherlands. Please see “Comparison of Rights of Shareholders.” |

| Q: | WHAT ARE THE CLOSING CONDITIONS TO THE MERGER? |

| A: | The Merger cannot be completed without satisfying certain conditions, the most important of which are that shareholders must approve the Merger at the Annual Meeting, and the aggregate number of shares of common stock in Nielsen-Netherlands for which a withdrawal application has been made shall represent less than 5% of the issued and outstanding share capital of Nielsen-Netherlands at the expiry of the withdrawal period. In addition, there are other conditions, which we expect to complete on a timely basis, such as the requirement to obtain authorization for listing the Ordinary Shares on the NYSE and receipt of certain legal opinions. Please see “Summary – Merger Conditions.” |

| Q: | WHEN DO YOU EXPECT THE MERGER TO BE COMPLETED? |

| A: | We intend to complete the Merger as quickly as possible. If the Merger is approved by the requisite vote of our shareholders and the other conditions to closing are satisfied, we will request a Dutch civil law notary (notaris) to issue a certificate attesting that Nielsen-Netherlands has observed all procedural rules in respect of all the required resolutions and that all pre-merger formalities under Dutch law have been complied with. In addition, we will request the issuance of an order by the UK High Court certifying that Nielsen-UK has completed properly the pre-merger acts and formalities in accordance with The Companies (Cross-Border Mergers) Regulations 2007 (the “UK Regulations”). Following this, a joint application will be submitted to the UK High Court by Nielsen-UK and Nielsen-Netherlands for the issuance of an order approving the completion of the Merger. The Merger will be effected not less than 21 days after the date of such order, which is currently expected to be in the third quarter of 2015. |

| We may decide to abandon the Merger at any time prior to the meeting. After the Merger is approved by shareholders, we must file with the UK High Court the joint application for the order approving the completion of the Merger in order to effect the Merger unless one of the conditions to closing fails to be satisfied. Please see “Summary – Merger Conditions.” |

| Q: | WHAT WILL I RECEIVE FOR MY NIELSEN-NETHERLANDS SHARES? |

| A: | You will receive, as consideration in the Merger, one Ordinary Share of Nielsen-UK in exchange for each share of Nielsen-Netherlands you hold immediately prior to the effective time of the Merger. |

| Q: | DO I HAVE TO TAKE ANY ACTION TO EXCHANGE MY NIELSEN SHARES AND RECEIVE THE ORDINARY SHARES THAT I BECOME ENTITLED TO RECEIVE AS A RESULT OF THE MERGER? |

| A: | Beneficial holders of shares held in “street name” through a bank, broker or other nominee will not be required to take any action. Your ownership of Ordinary Shares will be recorded in book entry form by your nominee, or broker or bank |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| (as they are today) through the facilities of The Depository Trust Company (“DTC”) without the need for any additional action on your part. |

| If you hold Nielsen-Netherlands share certificates or you are a registered uncertificated holder of Nielsen-Netherlands shares (i.e., if you hold shares in the Direct Registration System), you will be sent a deed of transfer, which is to be used to surrender your Nielsen-Netherlands share certificates, if applicable, and to request that Ordinary Shares be delivered to you or your designee, either in physical form or in “street name” through DTC. The deed of transfer will be accompanied by instructions explaining the procedure for surrendering your Nielsen-Netherlands share certificates and book-entry shares in exchange for Ordinary Shares of Nielsen-UK. Ordinary Shares will be initially delivered to the exchange agent for the Merger, for delivery to you, or in “street name” through DTC, upon return of the deed of transfer and surrender of the certificates representing shares of Nielsen-Netherlands, if applicable.YOU SHOULD NOT RETURN SHARE CERTIFICATES WITH THE ENCLOSED PROXY CARD.For more information, see “Proposals Relating to the Merger – Exchange of Shares; Delivery of Shares to Former Record Holders – Exchange of Shares for Registered Holders or Holders of Certificated Shares.” |

| Certificated or registered uncertificated holders of shares of Nielsen-Netherlands that elect to receive a share certificate representing Ordinary Shares of Nielsen-UK should particularly note that subsequent transfers of Ordinary Shares outside of DTC may attract UK stamp duty and stamp duty reserve tax (“SDRT”) under English law. For more information, see “Material Tax Considerations Relating to the Merger – UK Tax Considerations – Stamp duty and SDRT.”As a result, each former registered uncertificated holder or certificated holder of shares of Nielsen-Netherlands is strongly encouraged to provide the documents and information requested by the exchange agent in a timely manner, so any unrestricted shares may be held within the facilities of DTC. |

| Q: | WHAT HAPPENS TO NIELSEN-NETHERLANDS’S EQUITY-BASED AWARDS AT THE EFFECTIVE TIME OF THE MERGER? |

| A: | As a result of the Merger, Nielsen-UK will assume, and become the plan sponsor of, each employee benefit and compensation plan, arrangement and agreement that is presently sponsored, maintained or contributed to by Nielsen-Netherlands (including each equity and incentive plan and any outstanding award outstanding thereunder on the date of the Merger). |

| At the effective time of the Merger and pursuant to the terms of the Merger Proposal, each outstanding option to acquire shares of Nielsen-Netherlands and each other equity-based award issued by Nielsen-Netherlands that is outstanding immediately prior to the effective time of the Merger will be converted, as applicable, into an option to acquire or an award covering the same number of Ordinary Shares of Nielsen-UK, which option or award will have the same terms and conditions as the option or award from which it was converted (including, in the case of options, the same exercise price). |

| Q: | WHY WILL A REDUCTION OF CAPITAL BE UNDERTAKEN FOLLOWING THE MERGER? |

| A: | Under English law, Nielsen-UK will only be able to declare and pay future dividends, make distributions or repurchase shares out of “distributable reserves” on its statutory balance sheet. Immediately after the Merger, as a newly formed public limited company, Nielsen-UK will not have any distributable reserves because, under English law, the reserves previously held by Nielsen-Netherlands will not transfer to the statutory balance sheet of Nielsen-UK as a distributable reserve. However, the Merger will result in a “merger reserve” on the balance sheet of Nielsen-UK in an amount equal to the amount by which the net book value of the assets and liabilities transferred to Nielsen-UK from Nielsen-Netherlands pursuant to the Merger exceeds the nominal value of the Ordinary Shares issued pursuant to the Merger. In order to have sufficient distributable reserves to declare and pay future dividends following the Merger, Nielsen-UK will capitalize the merger reserve by issuing a non-voting bonus share. The non-voting bonus share will be issued with a share premium. Nielsen-UK will then undertake a court-approved procedure to cancel such share and the related share premium thereby creating distributable reserves which may be utilized by Nielsen-UK to pay dividends to shareholders following the capital reduction. |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| The current shareholder of Nielsen-UK (which is Nielsen-Netherlands) will pass a resolution to approve the proposed reduction of capital of Nielsen-UK following the Merger. If the Merger is completed, we will seek to obtain the approval of the UK High Court to the capital reduction as soon as practicable following the Merger. Subject to the availability of the UK High Court, we expect to receive such approval up to ten business days after the completion of the Merger. |

| Q: | CAN I TRADE NIELSEN SHARES BETWEEN THE DATE OF THIS PROXY STATEMENT/PROSPECTUS AND THE EFFECTIVE TIME OF THE MERGER? |

| A: | Yes. Our shares will continue to trade during this period. Please note, however, that, if you vote against the Merger, you cannot trade your shares in Nielsen-Netherlands if you would like to exercise your withdrawal rights. |

| Q: | AFTER THE MERGER IS COMPLETE, WHERE CAN I TRADE NIELSEN-UK ORDINARY SHARES? |

| A: | We expect the Nielsen-UK Ordinary Shares to be listed and traded in U.S. dollars on the NYSE under the symbol “NLSN,” the same symbol under which your shares are currently listed and traded. We do not intend to seek an additional listing on the London Stock Exchange. |

| Q: | ARE NIELSEN-NETHERLANDS SHAREHOLDERS ABLE TO EXERCISE WITHDRAWAL RIGHTS? |

| A: | Yes. If the Annual Meeting approves the Merger, any shareholder of Nielsen-Netherlands that voted against the Merger has the right to elect not to become a shareholder of Nielsen-UK and file a request for compensation in accordance with the Dutch Civil Code (“DCC”) within one month after the Annual Meeting. A withdrawing shareholder can only make use of the withdrawal right in respect of the shares in Nielsen-Netherlands that such shareholder (i) held at the record date of the Annual Meeting and for which such shareholder voted against the Merger and (ii) still holds at the time of submitting the withdrawal application and at the effective time of the Merger. Upon the Merger taking effect, the withdrawing shareholder will not receive Ordinary Shares. Instead, such withdrawing shareholder will receive cash compensation (net of any Dutch dividend withholding tax that is required to be withheld by law) for the common shares in Nielsen-Netherlands for which it duly exercised his withdrawal right and such shares of Nielsen-Netherlands shall cease to exist as a consequence of the Merger taking effect. See “Proposals Relating to the Merger – Withdrawal Rights.” |

| Q: | WHAT WILL I NEED IN ORDER TO ATTEND THE ANNUAL MEETING? |

| A: | We will be hosting the Annual Meeting live via the Internet. Any shareholder can attend the Annual Meeting live via the Internet atwww.virtualshareholdermeeting.com/NLSN. The webcast will start at 9:00 a.m. (Eastern Time). You will need your 16-digit control number included on your proxy card in order to be able to enter the Annual Meeting. Instructions on how to attend and participate via the Internet are posted atwww.virtualshareholdermeeting.com/NLSN. |

| Any shareholder can also attend our Annual Meeting at the offices of Clifford Chance, LLP at Droogbak 1A in Amsterdam, the Netherlands. Nielsen directors and members of management will attend the Annual Meeting via live webcast. The Annual Meeting will start at 9:00 a.m. (Eastern Time). To gain physical access to the Annual Meeting, you must bring photo identification along with the admission ticket included with your proxy card. A person who wishes to exercise the right to vote at the Annual Meeting in Amsterdam, the Netherlands must sign the attendance list prior to the meeting, stating his or her name, the name(s) of the person(s) for whom he or she acts as proxy, the number of shares he or she is representing and, as far as applicable, the number of votes he or she is able to cast. You may vote shares held through a bank, broker or other nominee in person in Amsterdam only if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares. Shares held through Nielsen’s 401(k) plan cannot be voted in person or online at the Annual Meeting. |

| Shareholders may vote and ask questions while attending the Annual Meeting. |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| A: | You are being asked to vote on the following proposals scheduled to be voted on at the Annual Meeting: |

| | |

| | To (a) approve the amendment of the articles of association of Nielsen-Netherlands in connection with the proposed Merger, and (b) authorize any and all lawyers and (deputy) civil law notaries practicing at Clifford Chance, LLP, Amsterdam, the Netherlands, to execute the notarial deed of amendment of the articles of association to effect the aforementioned amendment of the articles of association; |

| |

| | To approve the Merger; |

| |

| | To (a) adopt our Dutch statutory annual accounts for the year ended December 31, 20132014 and (b) authorize the preparation of our Dutch statutory annual accounts and the annual report of the Board of Directors required by Dutch law, both for the year ending December 31, 2014,2015, in the English language; |

| |

| | To discharge the members of the Board from liability pursuant to Dutch law in respect of the exercise of their duties during the year ended December 31, 2013;2014; |

| |

| | To elect the Directors of the Board as listed herein; |

| |

| | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2014;2015; |

| |

| | To appoint Ernst & Young Accountants LLP as our auditor who will audit our Dutch statutory annual accounts for the year ending December 31, 2014;2015; |

| |

| | To approve the Nielsen Holdings Executive Annual Incentive Plan; |

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | 1 |

GENERAL INFORMATION

| | |

| |

| | To approve the extension of the authority of the Board of Directors to repurchase up to 10% of our issued share capital (including depositary receipts issued for our shares) until November 6, 2015December 26, 2016 on the open market, through privately negotiated transactions or in one or more self tenderself-tender offers for a price per share (or depositary receipt) not less than the nominal value of a share and not higher than 110% of the most recently available (as of the time of repurchase) price of a share (or depositary receipt) on any securities exchange where our shares (or depositary receipts) are traded; |

| |

| | To approve, in a non-binding, advisory vote the compensation of our named executive officers as disclosed in the Proxy Statement/Prospectus pursuant to the SEC rules. |

| Among other things, you are being asked to vote to amend the articles of association of Nielsen-Netherlands and to approve a Merger between Nielsen-Netherlands and Nielsen-UK. The Merger will result in our establishing a new holding company to serve as the publicly traded parent of the Nielsen group and thereby changing the place of incorporation of our publicly traded parent from the Netherlands to England and Wales. As a result of the Merger, Nielsen-UK will own, directly or indirectly, all of the subsidiaries constituting the Nielsen group, and you will become a member (as shareholders are known in the UK) of Nielsen-UK. |

| We are also seeking approval of annual meeting proposals (Proposals 3 – 9) either because they are required under applicable Dutch or U.S. laws or because they are relevant for as long as Nielsen-Netherlands continues to be our parent company. |

| The shareholders may also vote at the Annual Meeting on such other matters as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

| Q: | WHO IS ENTITLED TO VOTE? |

| A: | Holders of shares of Nielsen-Netherlands common stock as of the close of business on May 29, 2015 (the “record date”) may vote at the Annual Meeting. |

| Q: | WHAT CONSTITUTES A QUORUM? |

| A: | There is no minimum requirement in order to establish a quorum at the Annual Meeting for the transaction of business. However, if less than 50% of the issued share capital is represented at the meeting, a higher percentage of the votes cast is required to approve the Merger. See “How many votes are required to approve each proposal?” below. |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| Q: | HOW MANY VOTES DO I HAVE? |

| A: | Shareholders holding shares of Nielsen-Netherlands common stock at the close of business on May 29, 2015 are entitled to one vote at our Annual Meeting for each share of our common stock held by them. As of May 19, 2015, Nielsen-Netherlands had 368,056,222 shares of common stock outstanding. |

| Q: | HOW MANY VOTES ARE REQUIRED TO APPROVE EACH PROPOSAL? |

| A: | A majority of the votes cast is required for the approval of the proposed amendment to the articles of association relating to the Merger. In addition, to be validly approved, the Merger requires a resolution of the general meeting of shareholders of Nielsen-Netherlands approving the proposed merger with a simple majority (>50%) of votes cast if at least 50% of the issued share capital is represented (either in person or by proxy) at the meeting. If less than 50% of the issued share capital is represented, a majority of 2/3 of votes cast is required. |

| Directors will be appointed by the majority of the votes cast in respect of the shares present or represented by proxy at the Annual Meeting and from the list of nominees presented herein. Shareholders may also appoint directors without the prior nomination by the Board of Directors by way of a shareholders’ resolution adopted with a majority of at least two-thirds of the votes cast, representing more than one-half of our capital stock. |

| A majority of the votes cast is also required for (a) approveadopting our Dutch statutory annual accounts for the year ended December 31, 2014, (b) authorizing the preparation of our Dutch statutory annual accounts and the annual report of the Board of Directors required by Dutch law, both for the year ending December 31, 2015, in the English language, (c) the discharge of members of the Board of Directors from liability pursuant to Dutch law, (d) the appointment of the auditors who will audit our Dutch statutory annual accounts and (e) the extension of the authority of the Board of Directors to repurchase our shares. |

| A majority of the votes cast is also required for the ratification of the appointment of the independent registered public accounting firm and the approval of the compensation paid to our named executive officers. It is important to note that these proposals are both non-binding and advisory. Therefore, the Company and/or the Board of Directors may determine to act in a manner inconsistent with the outcomes of such proposals. |

| Q: | HOW DOES THE BOARD OF DIRECTORS RECOMMEND THAT I VOTE? |

| A: | Our Board of Directors recommends that you vote your shares: |

| • | | “FOR” (a) the amendment of the articles of association to reflect the change of the name of the Company to Nielsen N.V.Nielsen-Netherlands, and (b) authorizethe authorization of any and all lawyers and (deputy) civil law notaries practicing at Clifford Chance, LLP Amsterdam, the Netherlands, to execute the notarial deed of amendment of the articles of association to effect the aforementioned amendment of the articles of association; |

| • | | “FOR” the approval of the Merger; |

| • | | “FOR” the adoption of our Dutch statutory annual accounts for the year ended December 31, 2014, and the authorization of the preparation of our Dutch statutory annual accounts and the annual report of the Board of Directors required by Dutch law, both for the year ending December 31, 2015, in the English language; |

| • | | “FOR” the discharge of the members of the Board from liability pursuant to Dutch law in respect of the exercise of their duties during the year ended December 31, 2014; |

| • | | “FOR” each of the nominees for Directors of the Board set forth in this Proxy Statement/Prospectus; |

| • | | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015; |

| • | | “FOR” the appointment of Ernst & Young Accountants LLP as our auditor who will audit our Dutch statutory annual accounts for the year ending December 31, 2015; |

| • | | “FOR” the approval of the extension of the authority of the Board of Directors to repurchase up to 10% of our issued share capital (including depositary receipts issued for our shares) until December 26, 2016 on the open market, through privately negotiated transactions or in one or more self-tender offers for a price per share (or depositary |

| | | | |

| | To approve, in | | 9 |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

| receipt) not less than the nominal value of a non-binding, advisory voteshare and not higher than 110% of the most recently available (as of the time of repurchase) price of a share (or depositary receipt) on any securities exchange where our shares (or depositary receipts) are traded; and |

| • | | “FOR” the approval of the compensation of our named executive officers as disclosed in thethis Proxy StatementStatement/Prospectus pursuant to SEC rules. |

| Q: | HOW DO I VOTE MY SHARES WITHOUT ATTENDING THE ANNUAL MEETING? |

| A: | If you are a shareholder of record on May 29, 2015, you may vote by granting a proxy: |

| • | | By Internet: If you have Internet access, you may submit your proxy by going towww.proxyvote.com and by following the rulesinstructions on how to complete an electronic proxy card. You will need the 16-digit Control Number included on your proxy card in order to vote by Internet. |

| • | | By Telephone: If you have access to a touch-tone telephone, you may submit your proxy by dialing 1-800-690-6903 and by following the recorded instructions. You will need the 16-digit Control Number included on your proxy card in order to vote by telephone. |

| • | | By Mail: By completing, signing and dating the enclosed proxy card where indicated and by mailing or otherwise returning the proxy card in the envelope provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

| For shares held in “street name,” you may vote by submitting voting instructions to your bank, broker or nominee. |

Internet and telephone voting facilities will close at 11:59 p.m. (Eastern Time) on June 25, 2015 for the voting of shares held by shareholders of record or held in “street name” and 11:59 p.m. (Eastern Time) on June 23, 2015 for the voting of shares held through Nielsen’s 401(k) plan.

Mailed proxy cards with respect to shares held of record or in “street name” must be received no later than June 25, 2015. Mailed proxy cards with respect to shares held through Nielsen’s 401(k) plan must be received no later than June 23, 2015.

| Q: | MAY I VOTE AT THE ANNUAL MEETING RATHER THAN BY PROXY? |

| A: | Although we encourage you to vote through the Internet or the telephone or to complete and return a proxy card prior to the Annual Meeting to ensure that your vote is counted, you can attend the Annual Meeting and vote your shares online or by submitting your proxy in person in Amsterdam. If you vote by proxy and also attend the Annual Meeting, there is no need to vote again at the Annual Meeting unless you wish to change your vote. |

| All holders of common stock as of May 29, 2015, including shareholders of record and shareholders who hold their shares through banks, brokers, other nominees or any other holders of record as of May 29, 2015, are encouraged to attend the Annual Meeting online. You will need your 16-digit control number included on your proxy card in order to be able to enter the Annual Meeting online. If you plan to vote in person in Amsterdam, please bring the admission ticket included with your proxy card and photo identification. If your shares are held in the name of a bank, broker or other nominee, please also bring with you a letter (and a legal proxy if you wish to vote your shares) from the bank, broker or other nominee confirming your ownership as of the Securities and Exchange Commission (the “SEC”).record date, which is May 29, 2015. Failure to bring such a letter may delay your ability to attend or prevent you from attending the meeting in Amsterdam in person. |

The shareholders may also vote at the Annual Meeting on such other matters as may properly come before the Annual Meeting and any adjournments or postponements thereof.

| Q: | WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE SET OF PROXY MATERIALS ON OR ABOUT THE SAME TIME? |

WHO IS ENTITLED TO VOTE?

Holders of shares of the Company’s common stock as of the close of business on April 8, 2014 (the “record date”) may vote at the Annual Meeting.

WHAT CONSTITUTES A QUORUM?

There is no minimum requirement in order to establish a quorum at the Annual Meeting for the transaction of business.

HOW MANY VOTES DO I HAVE?

Shareholders holding shares of our common stock at the close of business on April 8, 2014 are entitled to one vote at our Annual Meeting for each share of our common stock held by them. As of February 28, 2014, we had 379,045,472 shares of common stock outstanding.

HOW MANY VOTES ARE REQUIRED TO APPROVE EACH PROPOSAL?

Directors will be appointed by the majority of the votes cast in respect of the shares present or represented by proxy at the Annual Meeting and from the list of nominees presented herein. Shareholders may also appoint directors without the prior nomination by the Board of Directors by way of a shareholders’ resolution adopted with a majority of at least two-thirds of the votes cast, representing more than one-half of our capital stock.

A majority of the votes cast is also required for (a) adopting our Dutch statutory annual accounts for the year ended December 31, 2013, (b) authorizing the preparation of our Dutch statutory annual accounts and the annual report of the Board of Directors required by Dutch law, both for the year ending December 31, 2014, in the English language, (c) the discharge of members of the Board of Directors from liability pursuant to Dutch law, (d) the appointment of the auditors who will audit our Dutch statutory annual accounts, (e) the approval of the Nielsen Holdings Executive Annual Incentive Plan, (f) the extension of the authority of the Board of Directors to repurchase our shares and (g) the approval of the amendment to the articles of association to change the Company name to Nielsen N.V.

A majority of the votes cast is also required for the ratification of the appointment of the independent registered public accounting firm and the approval of the compensation paid to our named executive officers. It is important to note that these proposals are both non-binding and advisory. Therefore, the Company and/or the Board of Directors may determine to act in a manner inconsistent with the outcomes of such proposals.

| A: | It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card or, if you vote by Internet or telephone, vote once for each proxy card you receive. |

| | | | |

2014 Proxy Statement | | Nielsen Holdings N.V. | | 210 |

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

HOW ARE VOTES COUNTED?

| Q: | MAY I CHANGE MY VOTE OR REVOKE MY PROXY? |

| A: | Yes. Whether you have voted by Internet, telephone or mail, if you are a shareholder of record, you may change your vote and revoke your proxy by: |

Abstentions: Votes may be cast in favor of or against or you may abstain from voting. If you intend to abstain from voting for any director nominee or proposal, you will need to check the abstention box for such director nominee or proposal, in which case your vote will not have any effect on the outcome of the election of such director nominee or on the outcome of such proposal.

| • | | Voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m. (Eastern Time) on June 25, 2015; |

| • | | Submitting a properly signed proxy card with a later date that is received no later than June 25, 2015; |

| • | | Sending a written statement to that effect to our Corporate Secretary, provided such statement is received no later than June 25, 2015; or |

| • | | Attending the Annual Meeting, revoking your proxy and voting online or submitting your vote in person. |

| If you hold shares through the Nielsen 401(k) plan, you may change your vote and revoke your proxy by any of the first three methods listed above if you do so no later than 11:59 p.m. (Eastern Time) on June 23, 2015. You cannot, however, revoke or change your proxy with respect to shares held through the Nielsen 401(k) plan after that date, and you cannot vote those shares in person at the Annual Meeting. |

| If you hold shares in “street name,” you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy by attending the Annual Meeting online or by submitting your vote in person, provided that if your shares are held in “street name” you will need to obtain a proxy, executed in your favor, from the shareholder of record (bank, broker or other nominee) to be able to submit your vote in person. |

| We will honor the proxy with the latest date. However, no revocation will be effective unless we receive notice of such revocation at or prior to the Annual Meeting. For those shareholders who submit a proxy electronically or by telephone, the date on which the proxy is submitted in accordance with the instructions listed on the proxy card is the date of the proxy. |

| A: | Abstentions: Votes may be cast in favor of or against or you may abstain from voting. If you intend to abstain from voting for any director nominee or proposal, you will need to check the abstention box for such director nominee or proposal, in which case your vote will not have any effect on the outcome of the election of such director nominee or on the outcome of such proposal. |

| Broker Non-Votes: Broker non-votes occur when shares held by a bank, broker or other nominee are not voted with respect to a proposal because (1) the bank, broker or other nominee has not received voting instructions from the shareholder who beneficially owns the shares and (2) the bank, broker or other nominee lacks the authority to vote the shares at its/his/her discretion. Proposals Nos. 1, 2, 5 and 9 are considered to be non-routine matters under NYSE rules. Accordingly, any bank, broker or other nominee holding your shares will not be permitted to vote on those proposals at the meeting without receiving voting instructions from you. |

If you just sign and submit your proxy card without giving specific voting instructions, this will be construed as an instruction to vote the shares as recommended by management, so your shares will be voted “FOR” each director nominee listed herein (Proposal No. 5) and “FOR” Proposal Nos. 1, 2, 3, 4, 6, 7, 8 and 9, as recommended by the Board of Directors, and in accordance with the discretion of the holders of the proxy with respect to any other matters that may be voted on, in each case as indicated on the proxy card.

| Abstentions and broker “non-votes” will not affect the voting results. |

If you just sign and submit your proxy card without voting instructions, your shares will be voted “FOR” each director nominee listed herein (Proposal No. 3) and “FOR” Proposal Nos. 1, 2, 4, 5, 6, 7, 8 and 9, as recommended by the Board of Directors, and in accordance with the discretion of the holders of the proxy with respect to any other matters that may be voted on, in each case as indicated on the proxy card.Q: | WHO WILL COUNT THE VOTES? |

| A: | Representatives of Broadridge Financial Solutions, Inc. (the “Inspectors of Election”) will tabulate the votes and act as inspectors of election. |

HOW DOES THE BOARD RECOMMEND THAT I VOTE?

GENERAL INFORMATION ABOUT THE MERGER AND THE ANNUAL MEETING

Our Board of Directors recommends that you vote your shares:

| •| Q: | | “FOR” the adoption of our Dutch statutory annual accounts for the year ended December 31, 2013, and the authorization of the preparation of our Dutch statutory annual accounts and the annual report of the Board of Directors required by Dutch law, both for the year ending December 31, 2014, in the English language;

|

| • | | “FOR” the discharge of the members of the Board from liability pursuant to Dutch law in respect of the exercise of their duties during the year ended December 31, 2013;

|

| • | | “FOR” each of the nominees for Directors of the Board set forth in this Proxy Statement;

|

| • | | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2014;

|

| • | | “FOR” the appointment of Ernst & Young Accountants LLP as our auditor who will audit our Dutch statutory annual accounts for the year ending December 31, 2014;

|

| • | | “FOR” the approval of the Nielsen Holdings Executive Annual Incentive Plan;

|

| • | | “FOR” the approval of the extension of the authority of the Board of Directors to repurchase up to 10% of our issued share capital (including depositary receipts issued for our shares) until November 6, 2015 on the open market, through privately negotiated transactions or in one or more self tender offers for a price per share (or depositary receipt) not less than the nominal value of a share and not higher than 110% of the most recently available (as of the time of repurchase) price of a share (or depositary receipt) on any securities exchange where our shares (or depositary receipts) are traded;

|

| • | | “FOR” the approval of the amendment to the articles of association to change the Company name to Nielsen N.V.; and

|